Melissa Kopka/iStock Editorial via Getty Images

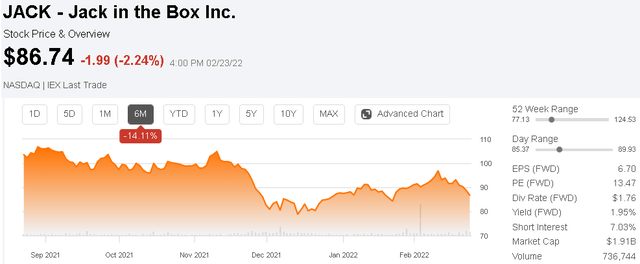

Jack in the Box, Inc. (JACK) operates and franchises 2,208 fast-food restaurants primarily in Western states with nearly half of all locations in California. Despite disruptions during the pandemic, the company has executed a strong recovery with the latest quarterly results highlighted by record revenues and same-store sales up from pre-pandemic levels. That said, headline-making inflationary cost pressures have hit margins which explains the more recent weakness in the stock over the last several months. Still, we are bullish on JACK as a category leader that trades at a discount to peers. The company’s pending acquisition of Del Taco Restaurants Inc (TACO) is set to add significant growth opportunities supporting a positive long-term outlook.

Seeking Alpha

JACK Earnings Recap

Jack reported its fiscal Q1 earnings on February 23rd with non-GAAP EPS of $1.97, which beat the consensus by $0.05, while a penny lower from the $1.98 result in the period last year. Revenue at $344.7 million was up 1.8% year-over-year between a 1.2% y/y same-store sales growth while the store count declined by 1.3% with a net decrease of 10 locations.

Management explains that the average ticket was up which balanced slightly softer store traffic against what was a difficult comparison period last year in the early stages of the reopening dynamic which generated a boost to the business. This quarter also faced some new pandemic challenges considering the Omicron-variant surge through January that likely temporarily impacted the operating environment. A key point here is that the comparable sales are up 13.7% on a 2-year basis highlighting the underlying strength of the business.

A key metric for the company is the restaurant level margin at 18.3% in the quarter which compares to 25.5% last year. Here, the factors contributing to the decline include a noted increase in food and packaging costs along with wage inflation of 10.9%. As an industry trend, costs have gone up for everything across food commodities like beef, pork, and oils. Jack in the Box has mitigated some of these trends with moderate menu price increases.

In other words, while the company was profitable this quarter with positive growth, earnings were less than optimal considering the circumstances. From the Q4 reported back in November, management had previously guided for 2022 restaurant-level margin in a range between 20-21% which means the earnings will need to improve through the second half of this year to reach that target.

Jack in the Box Del Taco Acquisition

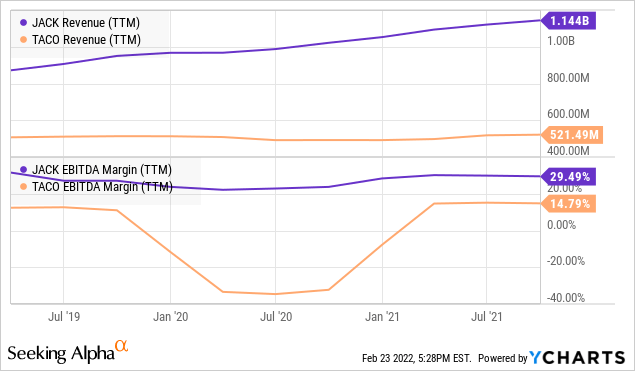

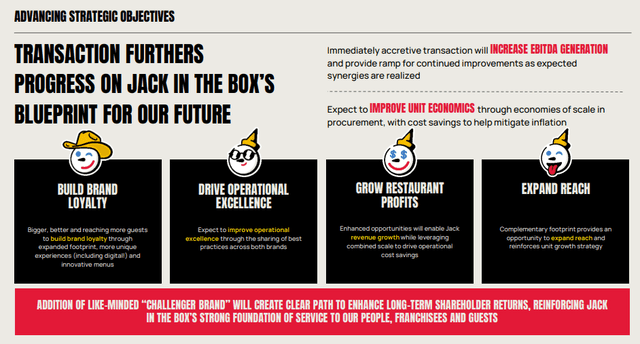

In December, Jack in the Box announced it was moving to acquire Del Taco Restaurants in a deal valued at approximately $575 million. Del Taco is recognized as the largest Mexican fast-food chain operating or franchising around 600 restaurant locations with a similar geographic footprint as Jack in the Box. TACO has generated about $521 million in revenue over the past year, about half of JACK’s $1.1 billion. Jack has historically been more profitable with a 29% EBITDA margin over the past year compared to 15% from TACO. The transaction is expected to close in the current quarter.

Comments by management suggest an expectation that the deal will be accretive to earnings immediately. While the two brands are different, the understanding is that the combined company will be stronger with a greater overall quick-service restaurant (QSR) market share while generating some cost savings through corporate synergies over the next two years.

source: company IR

In conjunction with the deal, Jack in the Box announced a $1.1 billion securitized financing facility which refinances a portion of the company’s existing $1.3 billion in long-term financial debt at the end of the last quarter while also funding a portion of the Del Taco acquisition. The company intends to stay within a guidance range for a leverage ratio between 4x and 5.5x.

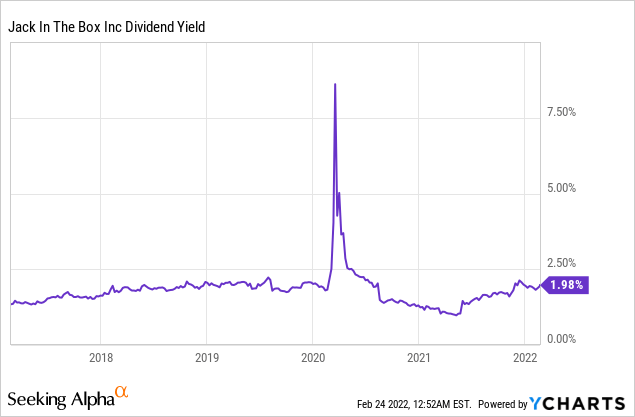

From the latest quarterly result considering JACK’s adjusted EBITDA of $320 million, we calculate a net debt to adjusted EBITDA leverage ratio of around 3.8x with an understanding that the level is supported by underlying cash flows. On this point, management has been comfortable with continuing the quarterly dividend of $0.44 per share which represents an annualized payout of around $37 million, yielding 2%. In November the company also announced a $200 million stock buyback program that is effective through 2023.

How Does JACK Stock Compare To Its Peers?

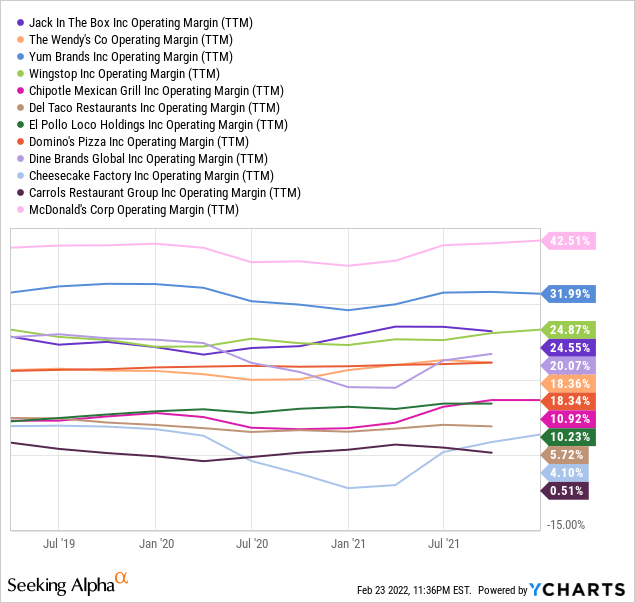

When looking at the restaurant industry among publicly traded stocks, it’s important to recognize that direct comparisons are difficult given the wide range of differences in the business models. Brands that rely heavily on franchising like Jack in the Box representing over 92% of all restaurant locations along with McDonald’s Corp (MCD), Domino’s Pizza Inc (DPZ), and Wing Stop Inc (WING) for example, are generally able to generate higher margins by limiting the capital-intensive requirements of running company-owned stores.

On the other hand, there are restaurant brands that do not franchise like Chipotle Mexican Grill (CMG) and Cheesecake Factory Inc (CAKE) to better control the quality and customer experience. Chipotle has been able to expand with strong organic growth while Cheesecake has taken a less aggressive approach. The advantage here is that the operators can capture the full restaurant-level operating margin which can scale higher and is sometimes more attractive than simply earning a royalty of franchise fee.

So putting it all together, we can still make the case that JACK screens well among its peers considering its combination of steady growth, current profitability, positive free cash flow. The company’s margins are also higher than some other quick service and casual dining names with an opening margin at around 25% over the past year, compared to names like Wendy’s Co (WEN), El Pollo Loco Holdings Inc (LOCO), Dine Brands Global Inc and even Chipotle The trend here adds to the point that JACK is a quality player within the industry.

Recent data suggest the company has captured market share within the QSR segment. According to the restaurant industry analytics group “MillerPulse”, JACK outperformed peers by 290 bps during the quarter in terms of same-store sales momentum. Our interpretation is that this trend reflects a brand connection with target market consumers as a strong point in the company’s long-term outlook.

Is JACK Stock Overvalued?

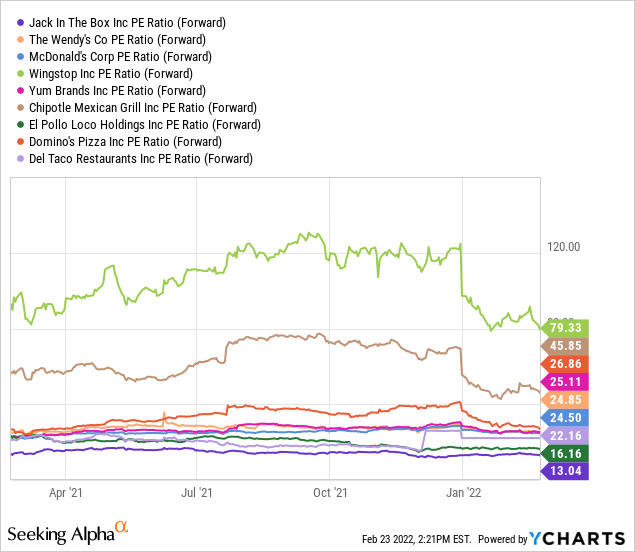

One metric that stands out is JACK’s forward P/E ratio at 13x which is among the lowest in a group of restaurant peers that are averaging above 20x. Jack also trades at a discount to the group average based on its EV to forward EBITDA ratio which standardizes earnings to each company’s debt level.

To be clear, a lot of the differences here are driven by each company’s size and growth outlook. Wingstop Inc, for example, is expected to grow sales and earnings by 30% this year during a rapid expansion phase. In this regard, Jack’s 2% top-line momentum this past quarter is less impressive and reflected in the discounted valuation. Nevertheless, we can call JACK the “value-pick” in the group.

What Is JACK Stock’s Forecast?

The growth outlook for Jack in the Box gets more interesting when it begins to incorporate Del Taco’s financials while also moving forward with the development of several new locations in its pipeline. With the latest quarterly update, the company has agreements for 201 new future restaurants, the highest level of restaurant commitments in company history.

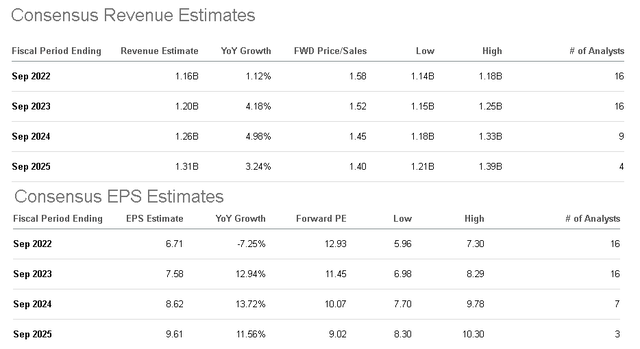

According to consensus, the forecast is for JACK revenue to reach $1.16 billion this year, up 1% over 2021. The trend accelerates for fiscal 2023 and 2024 with growth above 4% each year which is consistent with management’s long-term guidance of same-store sales growth between 2-3% while adding 1% to 3% more locations per year. The expectation is for earnings to ramp higher, an average of 12% each year between 2023 and 2025 based on the improved scale, normalizing operating environment, and Del Taco synergies.

Seeking Alpha

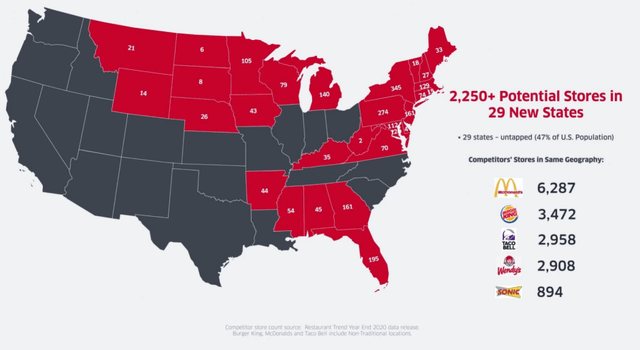

We believe there is an upside to these estimates, particularly on the top line with the ability to move forward with a national expansion. Looking just at the Jack in the Box brand, the company sees room for adding upwards of 2,250 potential stores in 29 untapped states and +6,000 locations total as a long-term addressable market. The attraction of Jack is its brand recognition from the West Coast that provides it with an immediate level of customer awareness.

source: company IR

Is JACK Stock A Buy, Sell, or Hold?

With the latest market development being the geopolitical tensions, the attraction of Jack in the Box and the U.S. restaurant industry is the reality that people still need to eat. Beyond the marginal impact of potentially weaker macro growth and softer near-term consumer spending as a result of inflationary pressures, it remains business as usual for the company.

Recognizing the ongoing market volatility, we rate JACK as a buy with a price target of $105 representing a 16x multiple on the current consensus 2022 EPS. This level will help the stock’s valuation converge higher with its peer group supported by what remains a positive outlook. If the company can execute on its growth strategy and deliver synergies from the Del Taco deal, we see more upside over the long run.

The next few quarters will be critical for the company to continue delivering positive same-store sales momentum as a key monitoring point. Weaker than expected results can open the door for a leg lower in the stock with a reassessment of the earnings outlook. The restaurant level margin is a key monitoring point.

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZVASKC7QUZGYBGFNSZLMQN7GCI.png)