Home care executives are expecting a few separate things to shake up the market in the coming years.

Among those are an increase in franchising, more private equity involvement and innovation to keep pace with higher costs.

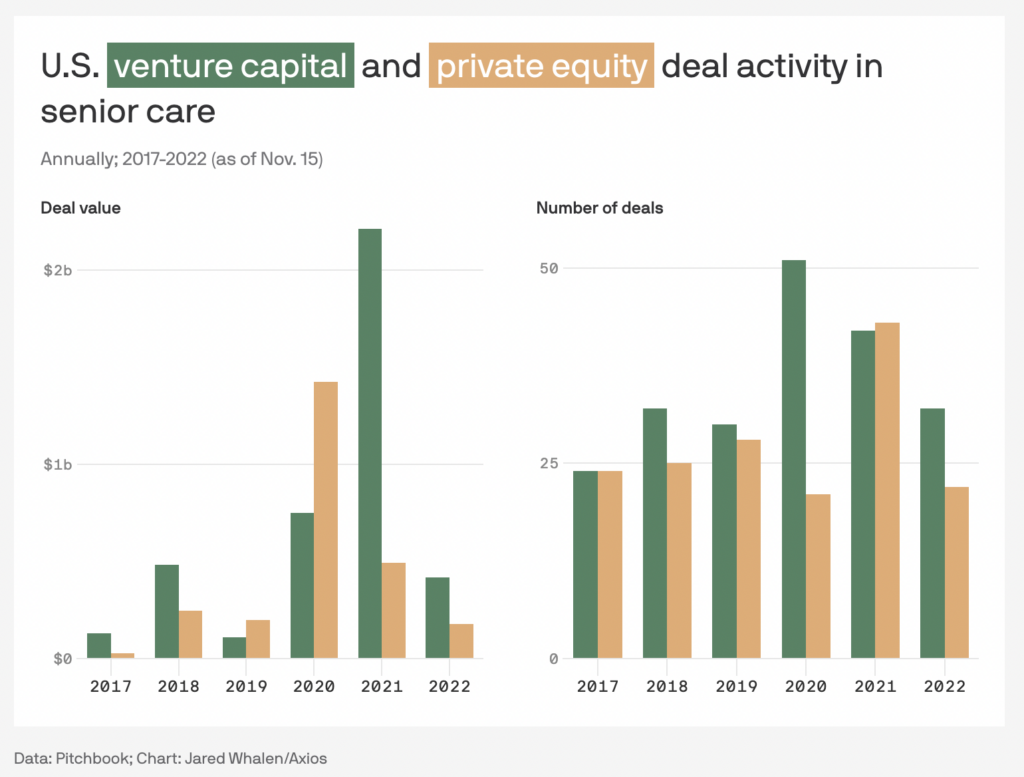

Consolidation in home care has lagged compared to home health care. One of the reasons why is that PE involvement in personal home care has also lagged.

“There are a lot of competitors who can enter [home care] and then there’s the ability for franchisees to expand and take share in the market,” Matt Sears, vice president of Bain Capital Double Impact, said at Home Health Care News’ Home Care Conference last week. “That makes it difficult for owned operations to drive scale. I also think how local the growth engine is in home care [makes it difficult for PE involvement]. You’re dealing with individuals who are making that buying decision and you’re recruiting in local markets. That forces a lot of separate market decision making and it’s hard to consolidate that into a corporate operation.”

Bain Capital Double Impact is a private equity company that has invested in the home care company Arosa.

J.J. Sorrenti, the CEO of Best Life Brands, believes that franchising may even see an uptick this year due to economic conditions. Generally, economic ups and downs increase franchising interest.

“When the economy sort of levels out, whether it levels out low or levels out high, franchising usually booms,” Sorrenti said at the Home Care Conference. “In our economy now, if we extend our toes, we could probably touch the bottom. While there may not be as much consolidation or M&A activity, I think you’re going to start to see some pretty significant growth from franchising because the economy is kind of settling.”

Best Life Brands is the parent company of the home care companies ComForCare and At Your Side, as well as the home health care company Boost Home Healthcare and other senior-focused franchise brands.

Franchising was almost non-existent in the months following the onset of the COVID-19 pandemic, Sorrenti said. Now that there is more clarity in the market, he expects franchise activity to pick up.

“I think 2023 will be a big number, from a unit growth perspective, of franchising for all of us that are franchisors,” he said.

A further PE entrance

In 2018, Bain Capital Double Impact acquired Arosa and LivHome, taking two regional health care companies and creating a national in-home care provider.

While similar, large-scale investments by PE might not be in the cards for home care in 2023, the industry can still bank on the tailwinds that come with increased demand.

Devin O’Reilly – managing director at Bain Capital – told Axios this week that private equity funding is following the innovations that come with home-based care as opposed to nursing homes and long-term-care facilities.

Coming out of the pandemic, investors are now focused on funding care delivery and technology companies that address the need for people living independently and for longer.

“I think in the long-run in personal care, home care, there’s an advantage to having 20 or 30 locations, having a scaled operation, having a little more leverage when it comes to driving growth,” Sears said. “There’s also this massive tailwind behind this industry that’s constantly attracting investors. I think you’ll continue to see dollars come in to support companies like Arosa or other semi-scaled or scaled home care providers and that’s going to more gradually drive the consolidation. It’s just not happening as quickly as other industries.”

Arosa – the home care provider that has 28 locations across eight states — is led by CEO Ari Medoff. In order for home care agencies to be more attractive to private equity, Medoff believes there needs to be some innovation implemented in how agencies do business.

“I think it is bananas that there are 40,000 or 50,000 home care companies out there in the country, and how many of those are trying business models that are not billing 2X and paying X?” Medoff asked. “Less than 1%? The lack of innovation around business models in our space is devastating.”

That model doesn’t serve enough clients because bill rates are too high, Medoff said. At the same time, the pay rates are not high enough for caregivers to afford a living wage.

“I think we desperately need new business models in our space,” Medoff said. “I’m not just talking about trying to figure out how Medicare or some other third party payer will pay the bill. A lot of energy goes into talking about that and dreaming about that, but I think it is incumbent upon us to think about how we bring value to clients in a different way that can lower bill rates and can raise pay rates.”

Partnering with private equity can solve some of those problems, Medoff said. He’s seen that firsthand. However, it’s also an expensive partnership to maintain.

“Having the access to capital and the ability to get towards a scale where you can have a management team and a leadership team make these changes is crucial,” Medoff said. “But let’s also be honest — it is expensive to be a multi-state provider and it is expensive to partner with private equity. For example, we didn’t used to get audits that cost six figures with accounting firms.”

For providers, there’s no denying that having financial backing — whether that be from PE or a franchisor — helps alleviate some of the stressors that come with running a business.

Sorrenti learned that lesson years ago when he was working for a different company at the closing table as he and his colleagues were buying a founder-led business.

“They were converting their business into our franchise, and as soon as he [signed the papers], he looked over at me and said, ‘Thank God, now I can start making all the investments in the company because it’s your money, not mine,’” Sorrenti recalled. “I was kind of offended by that at first, but he was so risk-averse because he was holding on to this beautiful business that he had built for 20 years. But now the reins were off, he had somebody else’s capital and the business flourished.”