picture/iStock via Getty Images

Franchise Group, Inc. (NASDAQ:FRG) is one of the leading multi-brand operators of health and wellness brands and home furniture in the US. They operate under 6 business lines including The Vitamin Shoppe (“Vitamin Shoppe”), Pet Supplies Plus, Badcock Home Furniture & More (“Badcock”), American Freight, Buddy’s Home Furnishings (“Buddy’s”), and Sylvan Learning (“Sylvan”). Despite being a small-cap stock with a market capitalization of $1.57 billion, FRG managed to remain profitable during the height of the pandemic and remained resilient during the transition to the new normal with its steadily increasing earnings.

FRG will achieve long-term profitability as a result of the continued demand for health and wellness products, the prolonged appreciation for home furnishings, and the expansion of online tutoring services.

FRG has a forward dividend yield of 6.82%, a payout ratio of 23.17% (GAAP), and a $500 million stock buyback program as a catalyst. It has a growing operating margin and growing net income from continuing operations. FRG is now inexpensive and is expected to reach its average price target of $63.83.

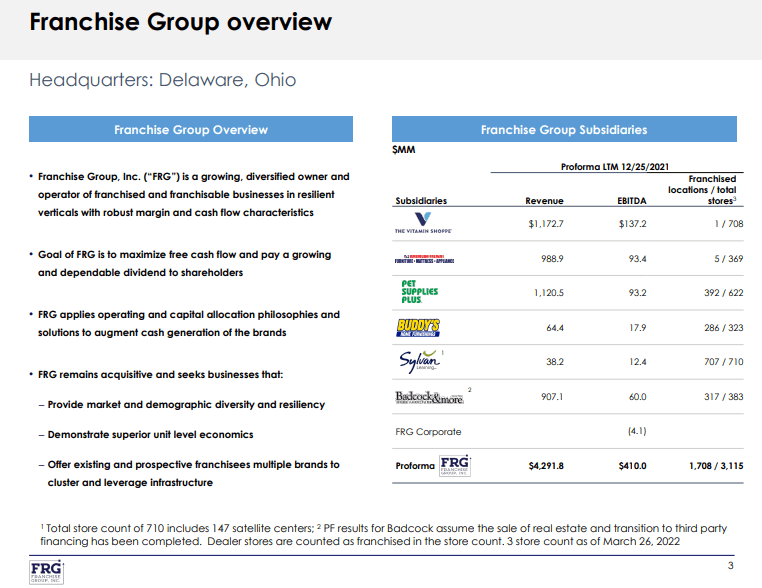

Company Background

This quarter, FRG generated revenue from the sale of its goods, rental revenue, financing services, and franchise-related revenue, and its long-term plan includes maintaining an asset-light business model with predictable and recurring revenue. In FY2021, they had significant divestitures with their Liberty Tax Business, which frightened certain investors due to the potential downward revision of its top line.

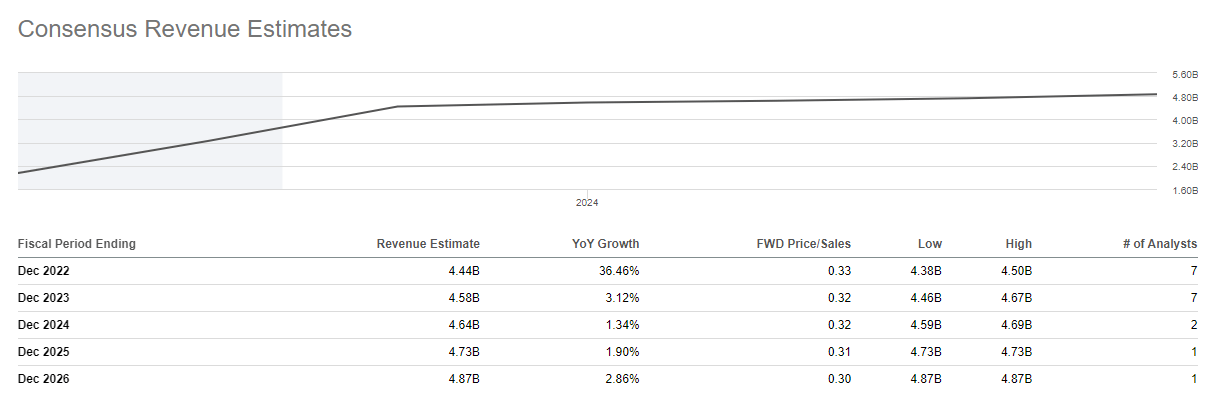

FRG: Growing Consensus Revenue Estimates (Source: SeekingAlpha.com)

However, looking at its current top-line projection as of this writing reveals a different story: despite certain divestitures, FRG was able to purchase significant brands and generated franchising momentum that improved this trajectory without the use of equity financing. These acquisitions include Pet Supplies Plus, Sylvan learning, W.S. Badcock Corporation and their recent acquisition of Wag N’ Wash.

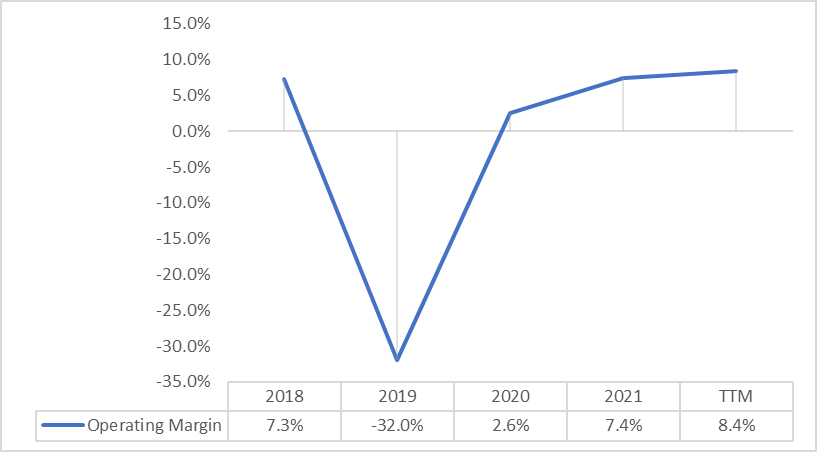

Despite today’s high inflationary environment, FRG’s expanding operating margin is a crucial value-adding catalyst as of the writing of this article. This is due to their profitable business strategy in which franchisees cover the majority of operating expenses.

FRG: Growing Operating Margin (Source: Data from SeekingAlpha. Prepared by InvestOhTrader)

Looking at its net margin on the other hand, it declined from 2.22% recorded in Q1 2021 to 1.08% this quarter and this is due to a bloated net income of $13.8 million in Q1 2021 which includes $42.14 million income related to the discontinued operation of its Liberty Tax Business. Taking a closer look at its continuing operations, FRG’s net income of $12.3 million for Q1 2022 actually improved this quarter when compared from -$28.33 million in Q1 2021.

Interesting At Its Badcock Acquisition

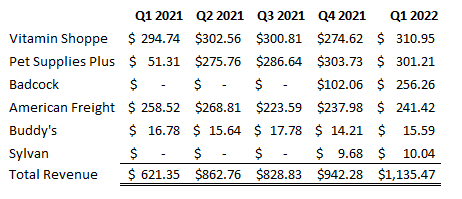

FRG: Operating Segment’s Total Revenue Trend (Source: Company Filings. Prepared by InvestOhTrader. Amounts in Millions)

With its latest acquisition, FRG received the majority of its revenue from its home furnishings company, as opposed to Q1 2021, when that figure was only 44.3%. This can put pressure on FRG’s top line, especially in light of today’s rising interest rates and housing shortage, which act as a headwind for the overall housing market. In actuality, its American freight segment’s revenue of $241.2 million and Buddy’s revenue of $15.59 million were lower than their respective Q1 2021 figures.

Looking at its Badcock segment, it currently helped FRG to boost their top line to almost twofold amounting to $1,135.47 million, when compared to $621.35 million recorded in Q1 2021. However, it negatively impacted the company’s net income this quarter by a total of -$2.86 million. This is likely one of the reasons why management is selling off its non-core businesses associated with its recently acquired Badcock segment. In addition, the management demonstrated their ability to purchase low and sell high with their anticipated profit from the aforementioned plan divestitures.

During the quarter we entered into a series of real estate transactions with Badcock. We’ve closed one generating gross cash proceeds of $94 million and we’ve signed definitive purchase and sale agreements for Badcock distribution centers, corporate headquarters and other real estate for combined more than $170 million of additional cash proceeds.

The majority of the Badcock Real Estate transactions are expected to close in the current quarter and combined with the $400 million of consumer receivables sold in December. All of these transactions will bring our gross proceeds from the sale of non-core assets at Badcock to over $660 million since we closed on the purchase of Badcock for $580 million last November.

Gaining Franchise Momentum

On top of its wild merger and acquisition activities, FRG is actually gaining franchise momentum.

FRG: Growing Franchise Location (Source: Q1 2022 Investors Presentation)

This quarter, Buddy’s opened ten more franchise stores and awarded twelve more area development agreements, increasing the total number of backlogged franchise locations to 102. Regarding its Pet Supplies Plus segment, the company has 19 new store openings and the sale of 21 new franchise agreements, bringing the total backlog of PSP sites to 216. In addition, Vitamin Shoppe obtained the same franchising momentum with the opening of 12 additional stores. If properly funded, this represents a significant development opportunity for the company, especially given their expanding geographic footprint in the US. Despite the headwinds, I believe its growing projected top line is achievable.

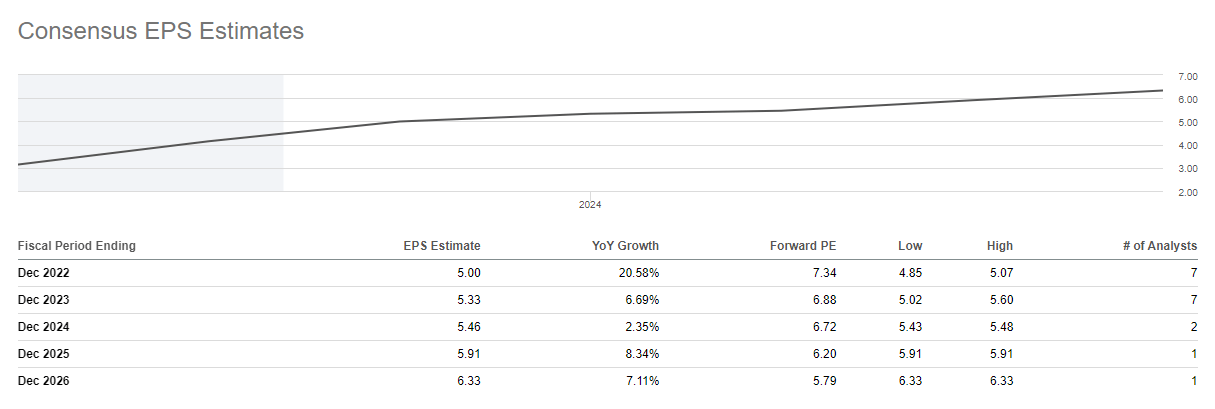

Its Growing EPS Outlook

In Q1 2022, the management reaffirmed its FY2022 sales forecast of about $4.45 billion and Non-GAAP EPS of $5, representing a YoY increase of approximately 20.58%. In addition, analysts anticipate that the company’s EPS will continue to increase in FY 2022, as depicted in the graphic below.

FRG: Growing EPS Trend (Source: SeekingAlpha.com)

Cheap FRG

Looking at the company’s trailing P/E ratio of 6.73x compared to its forward P/E 11.03x, we can assume FRG is actually expensive as of this writing. However, considering its sector’s median of 11.76x and its 2-year average of 25x, we can initially say it is not actually overvalued. Moving to its trailing P/S ratio of 0.39x, and comparing its 5-year average of 0.82x and considering its forward P/S ratio of 0.33x, FRG is relatively undervalued. Considering both valuation multiples with an estimated EPS of $5.18, a revenue per share of $111.5 in FY2024, and a discount rate of 8.5%, we can arrive at a conservative $60-ish price target.

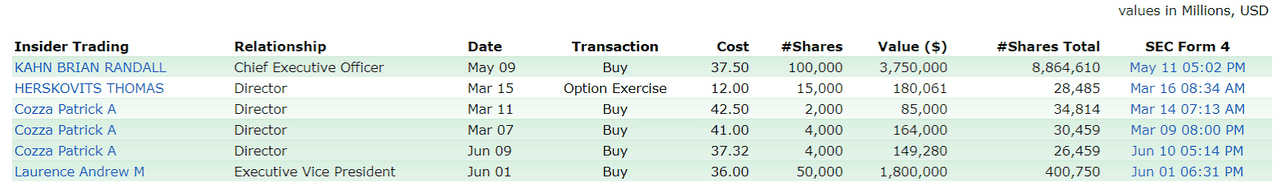

Unusual In Today’s Bearish Environment

FRG: Positive Insider Trading (Source:Finviz.com)

Looking at its positive insider trading as shown in the image above, the management tells us not through words but with their action that FRG is actually undervalued as of today. This is especially true considering their strong buyback authorization catalyst of $500 million, the management will be happy if price goes deeper, especially considering its current 40.4 million shares outstanding, making this stock cheap at today’s price.

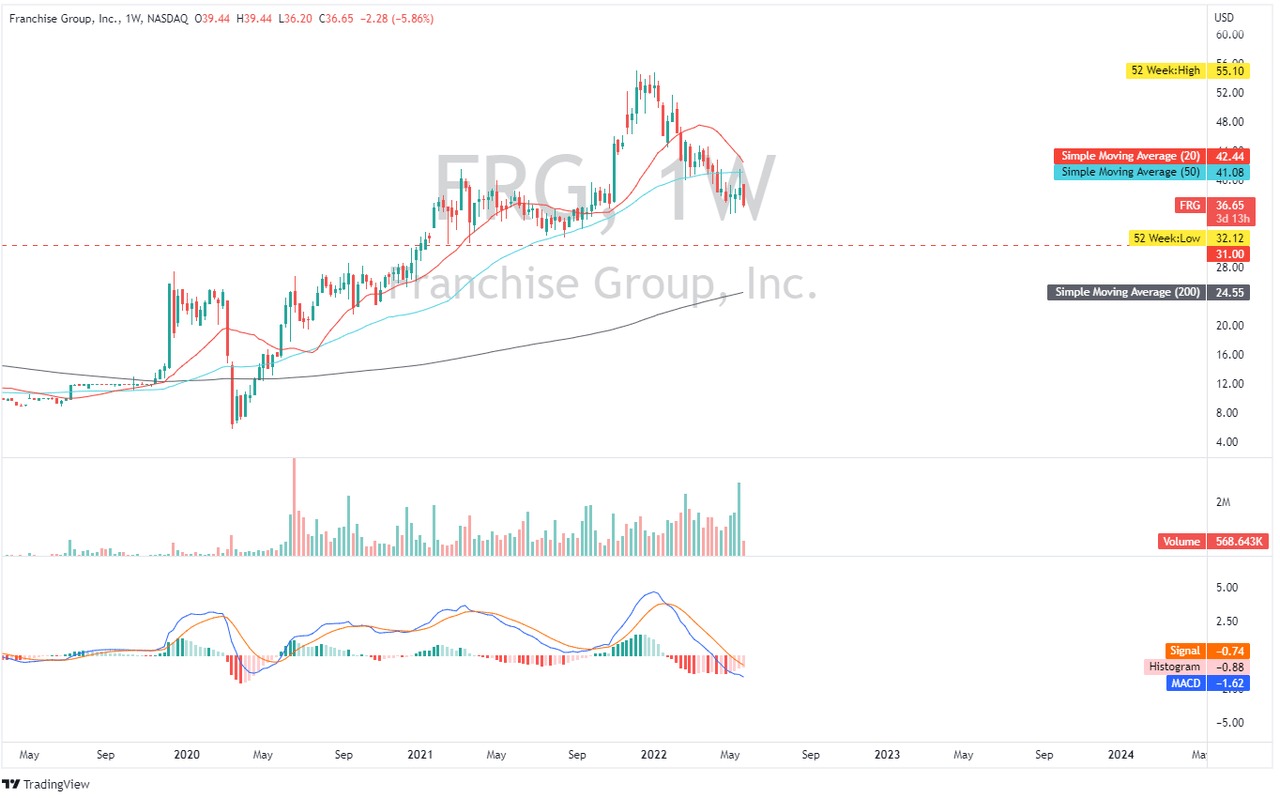

Buy The Dip

FRG: Weekly Chart (Source: TradingView.com)

Looking at its weekly chart, we can observe that we are nearing a strong support zone between $31 and $37. I predict a consolidation inside this range, and if the $31 support fails to hold, I estimate $28-ish to be the subsequent strong support. Surprisingly, 8.75% of the stock is shorted at the time of this writing. In addition, with only 49.65% of shares held by institutions, I believe FRG could be an excellent target for a future short squeeze if there is a major M&A catalyst.

Final Key Takeaways

FRG’s high forward dividend yield of 6.82% can be challenged by its high Non-GAAP payout ratio of 62.86%. Especially considering the current inflationary worries, FRG’s profitability could be hampered, putting its dividend yield at risk. Nevertheless, I believe FRG will remain profitable, especially in light of the company’s rising operating margin and adjusted EBITDA projections from management.

If the company’s finances are in any way precarious, I believe management will not present an optimistic outlook for reducing its net debt below $1.1 billion by the end of fiscal year 2022. Additionally, FRG was able to create an improvement in its debt/EBITDA ratio, which decreased to 6.33x from 8.39x in the prior fiscal year. Taking into account its debt-to-equity ratio, we can observe that it improved this quarter to 3.33x from 3.41x in the prior fiscal year.

FRG has been reorganizing its assets in a profitable manner and continues to expand with an exceptional M&A track record. This stock is quite undervalued and has an intriguing brand portfolio that is prepared to cater to the new normal, making it a worthy addition to your income portfolio.